TL;DR

The NDIS software review 2025 reveals a year of real transformation. Platforms evolved into integrated systems that support compliance, workforce management, and participant outcomes. Providers adopted scalable, interoperable solutions with automation, advanced reporting, and user-friendly design. Pricing shifted toward value-based models. Market leaders like Vertex360 set new standards, positioning providers for operational efficiency, growth, and data-driven decision-making in 2026.

A Defining Year for NDIS Software

The year 2025 marked a decisive shift in NDIS technology. Software platforms moved well beyond basic administrative functions. Providers increasingly relied on integrated systems that supported compliance management, workforce coordination, financial oversight, and participant outcome tracking — all within a single operational environment.

This NDIS software review 2025 reflects how the sector responded to heightened regulatory scrutiny, accelerated vendor consolidation, and rising expectations for digital efficiency. Software selection became a strategic decision. It directly influenced operational resilience, audit readiness, and long-term sustainability across the NDIS software market in 2025.

According to the NDIS Commission’s registration and compliance framework, registered providers face increasing obligations around documentation, incident reporting, and service quality — making software capability a direct compliance variable, not just an operational convenience.

Key developments that defined the year included:

- Greater adoption of end-to-end platforms replacing fragmented systems

- Increased focus on automation to reduce administrative burden and errors

- Stronger demand for interoperability with finance, payroll, and reporting tools

For providers planning 2026 strategies, this year-end NDIS analysis highlights why technology investment is no longer optional. Understanding how NDIS technology 2025 matured is essential for making informed decisions around system optimisation, scalability, and future-ready service delivery. If you are evaluating your current tools, the complete NDIS software buyer’s guide is a practical starting point.

Market Evolution Summary in 2025

The NDIS software market in 2025 experienced accelerated consolidation as larger vendors acquired niche platforms to broaden feature depth and strengthen market position. This consolidation reduced fragmentation and encouraged providers to transition away from standalone tools toward unified, end-to-end software ecosystems.

Smaller and mid-sized providers increasingly adopted integrated platforms that combined service delivery, workforce management, invoicing, and compliance workflows. This shift reduced system complexity and improved operational visibility — reinforcing the value of scalable solutions within the evolving software industry review landscape.

The 2025 NDIS Annual Report highlighted continued growth in registered provider numbers, placing greater pressure on software vendors to deliver solutions that scale with participant demand without increasing administrative overhead.

Interoperability emerged as a key competitive differentiator. Providers demanded seamless integration with accounting, payroll, CRM, and reporting systems. Platforms offering native integrations and open APIs reduced manual workarounds, improved data accuracy, and supported more reliable decision-making. Providers considering a switch will find it useful to review why small providers need different software than enterprises before committing to a platform.

Pricing Trend Analysis Across the Sector

During 2025, NDIS software pricing models underwent significant evolution. Higher development costs, expanded platform functionality, and increasingly complex provider requirements all drove this change. Traditional flat-fee structures declined as vendors adopted tiered subscription models and usage-based pricing, linking costs to participant numbers, workforce size, or platform utilisation.

For small to medium providers, these pricing changes presented both opportunities and challenges. Scalable models allowed growing organisations to expand without immediate cost spikes. Smaller operators required careful forecasting to ensure software costs remained aligned with actual usage and budget constraints. The NDIS Pricing Arrangements and Price Limits published by the NDIA set the funding boundaries within which providers must operate — making cost-efficient software a direct financial necessity.

Platforms with transparent value propositions gained strong preference across the sector. Vertex360’s participant-based pricing — starting at $31.50 per month — demonstrated exactly how transparent pricing builds provider confidence and reduces evaluation friction. Providers knew their costs before signing up, without hidden fees or “contact for a quote” barriers. To understand what hidden fees look like across the market, see NDIS software pricing: hidden costs revealed.

Several strategic considerations shaped pricing decisions in 2025:

- Alignment of cost with platform capabilities, ensuring pricing reflects features, compliance support, and operational benefits

- Transparency in billing, reducing hidden fees and increasing provider trust

- Flexibility to scale, allowing providers to adjust subscriptions in line with workforce growth or participant numbers

Providers increasingly prioritised long-term value over upfront cost. They assessed platforms for scalability, functional depth, and return on investment. This year-end NDIS analysis confirms that pricing strategy is now a critical factor influencing technology decisions heading into 2026.

Feature Development Highlights in 2025

In 2025, NDIS software development prioritised automation and compliance. Core operations such as service bookings, progress notes, and invoicing were streamlined, reducing errors and improving operational speed. Providers redirected resources from administration toward improving participant outcomes.

User experience received significant focus. Platforms introduced intuitive navigation and simplified interfaces. Training time decreased and adoption rates improved when software reflected real-world service delivery processes. This highlighted the importance of design aligned with daily provider operations.

Key feature enhancements during 2025 included advanced workflow automation, enhanced reporting for compliance and operational insight, improved integration across systems, and optimised mobile interfaces. These improvements positioned software as a strategic operational tool rather than a purely administrative resource.

Integration and Interoperability Improvements

System integration became a critical requirement for providers in 2025. Seamless connectivity between NDIS software, finance, payroll, and workforce management systems became essential. Platforms supporting open APIs and native integrations reduced manual data entry, duplication, and reporting errors.

Providers increasingly selected software that could synchronise operations across multiple departments. This improved transparency, efficiency, and compliance outcomes. Streamlining support coordination with advanced software became a practical benchmark many providers used when evaluating platform maturity.

The most successful platforms delivered interoperability that allowed real-time data sharing, automated reconciliation, and smoother workflow coordination. These capabilities strengthened provider decision-making and ensured consistent service delivery across the organisation.

User Experience and Workforce Adoption

User experience emerged as a key differentiator in 2025. Platforms prioritised intuitive design, mobile accessibility, and operational alignment. Staff engagement increased when software closely reflected daily service delivery and administrative tasks.

Mobile-enabled platforms allowed frontline teams to access participant records, log progress, and update service data in real time. This flexibility improved efficiency in community-based and remote service environments, reinforcing workforce productivity and adoption. The Vertex360 worker mobile app gave field staff a direct operational tool accessible from any location.

Providers reported higher satisfaction when software reduced cognitive load, simplified reporting, and enhanced real-time visibility. NDIS technology in 2025 became a strategic tool for operational effectiveness and staff engagement.

Vendor Performance Comparison

In 2025, market-leading NDIS software vendors demonstrated consistent feature delivery, reliable system performance, and responsive customer support. Providers assessed vendors based on platform stability, transparency, and alignment with regulatory requirements.

The sector split into two clear performance tiers during the year.

Enterprise-grade platforms (such as SupportAbility and Brevity) served larger organisations with complex feature sets and module-based structures. These platforms offered depth but often required lengthy implementation timelines and lacked pricing transparency, creating evaluation friction for smaller providers. For providers weighing these options, the Brevity alternative comparison and the SupportAbility alternative analysis offer direct breakdowns.

SME-focused platforms (such as Vertex360 and ShiftCare) served small to medium providers with faster implementation timelines and clearer pricing structures. The key differentiator within this tier was pricing model transparency. ShiftCare’s per-user model created scaling cost uncertainty for providers growing their teams. Vertex360’s participant-based pricing removed this uncertainty entirely. The ShiftCare vs Vertex360 pricing comparison provides a detailed cost breakdown across team sizes.

How Innovation and Customer Trust Shaped Vendor Performance

Innovation alone did not guarantee adoption or long-term provider confidence. Providers valued vendors that combined predictable development roadmaps, clear communication, and alignment with compliance and operational workflows. Platforms delivering both stability and targeted innovation earned sustained trust and strengthened their market position.

Key factors influencing vendor performance in 2025 included:

- Feature reliability and release consistency, ensuring tools remain up to date and fully compliant

- Customer support responsiveness, directly impacting provider satisfaction and adoption

- Alignment of innovation with operational workflows, balancing new capabilities with user needs and compliance standards

This focus on reliability, usability, and measured innovation shaped competitive positioning across the NDIS software market in 2025. Software success depended on both operational stability and strategic advancement.

Vertex360 2025 Achievements

In 2025, Vertex360 strengthened its position in the NDIS software market through targeted feature development and platform stability. System improvements supported compliance workflows and operational visibility. Providers managed complex participant and workforce needs efficiently from a single platform.

Specific platform advancements during the year included:

- AI-powered shift notes — reducing manual documentation time for support workers while improving progress note quality and consistency

- Worker mobile app enhancements — giving frontline staff real-time access to participant records, shift schedules, and service logs from any location

- Internal audit report (Platinum plan) — a $1,200-valued compliance tool that gave providers structured insight into their audit readiness without engaging external consultants

- 7-day free trial — allowing providers to test all features before committing, with no credit card required

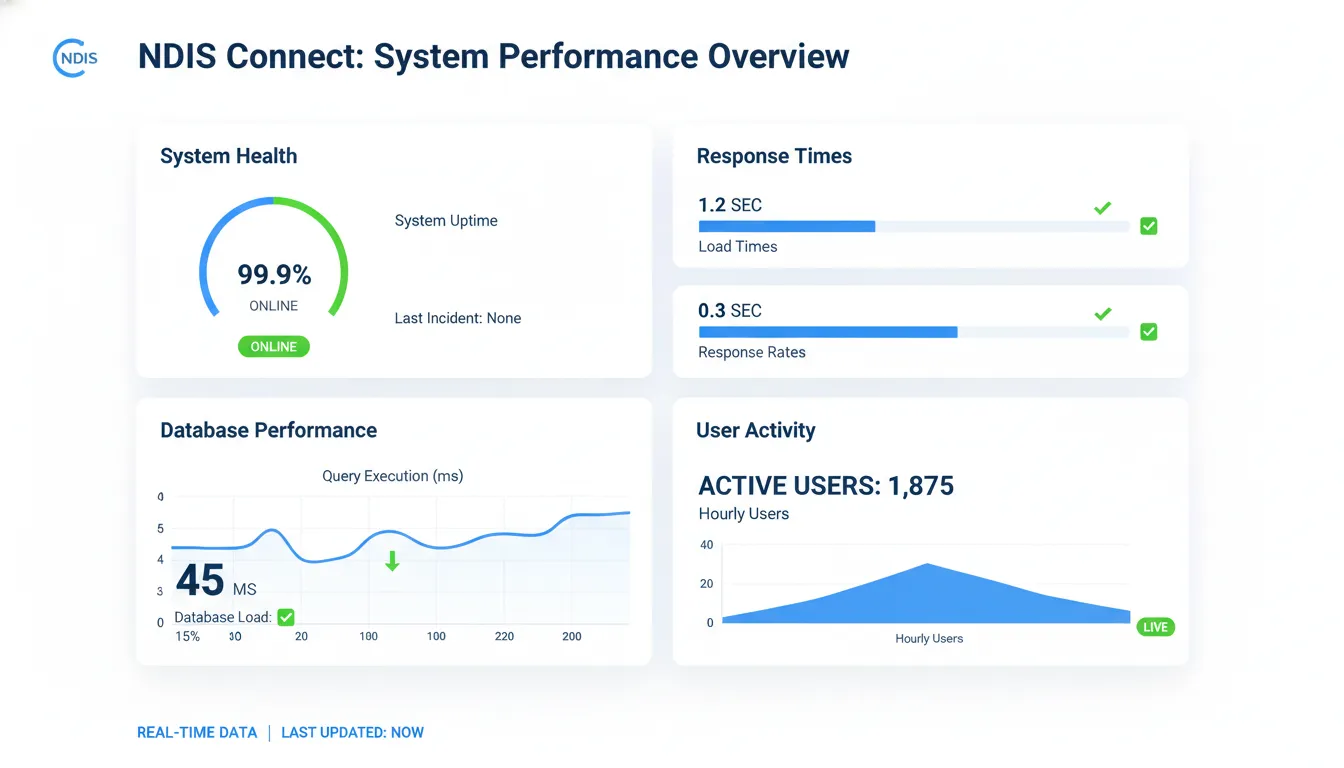

Customer adoption and platform growth reflected rising demand for integrated solutions combining service delivery, reporting, and financial oversight. Vertex360 maintained a 4.8 rating from verified providers, reflecting consistent satisfaction with support responsiveness and platform reliability. Peak performance stability during high-volume periods reinforced provider confidence. Providers exploring a switch can review real results from NDIS software switches to understand the practical outcomes others have experienced.

Regulatory Alignment and Compliance Support

Compliance requirements intensified throughout 2025, increasing demand for audit-ready, traceable systems. Vertex360’s compliance-focused architecture reduced administrative risk by ensuring accurate documentation, consistent service records, and error-free claim processing. Learn more about how Vertex360 simplifies NDIS compliance management.

Automation supported operational consistency across service delivery, financial reconciliation, and workforce management. Platforms that aligned with regulatory expectations gained competitive advantage, further establishing Vertex360 as a trusted partner across the NDIS software market.

Key compliance-focused enhancements included:

- Automated record keeping and progress note verification for audit readiness

- Integration with finance and workforce systems to reduce manual errors

- Workflow consistency that supports accurate claims and service documentation

Operational Insights and Lessons Learned from 2025

Year-end data highlighted a strong correlation between software maturity and operational efficiency. Providers using integrated platforms reported faster invoicing, reduced compliance errors, and improved data visibility for strategic planning.

The year-end NDIS analysis reinforced that software selection directly impacts provider resilience. Platforms that failed to evolve or support scalability lost relevance quickly. Those prioritising long-term alignment delivered measurable operational benefits.

Providers also learned to recognise avoidable mistakes early. The most common errors — from poor implementation planning to choosing platforms that penalise staff growth — are documented in NDIS software mistakes small providers make. Understanding these pitfalls informed smarter purchasing decisions heading into 2026.

Providers learned to evaluate software on its ability to support growth, compliance, and workforce productivity — not just upfront cost. These lessons provide direct guidance for NDIS technology decisions and system optimisation heading into 2026.

2026 Outlook: What Providers Should Expect

Looking ahead, 2026 is set to bring deeper automation, advanced predictive analytics, and strengthened interoperability across the NDIS software market. Providers will increasingly require platforms that enable proactive management, real-time decision-making, and efficient workflow execution. Technology will continue to be a critical driver of operational performance and participant outcomes.

Market consolidation is expected to continue, favouring software vendors with demonstrated scalability, strong compliance capabilities, and mature integration features. Platforms delivering a combination of operational reliability and responsive support will maintain a competitive edge. Innovation will focus on decision support and actionable insights rather than solely on data capture.

Emerging trends shaping 2026 include:

- Advanced workflow automation, reducing administrative effort and improving accuracy

- Predictive analytics and operational reporting, supporting strategic, data-driven decisions

- Enhanced interoperability, enabling seamless integration with finance, payroll, and workforce management systems

Strategic Opportunities for Providers in 2026

Providers entering 2026 should prioritise technology solutions that enhance efficiency, transparency, and service quality while maintaining compliance. Advanced platforms will increasingly influence competitive positioning. Early adopters gain operational leverage and long-term strategic advantage. Technology alignment is essential to sustainable growth in a regulated environment.

Adopting scalable software allows providers to optimise workforce productivity, improve participant experiences, and mitigate operational risks. Platforms capable of adapting to evolving provider needs will ensure long-term resilience and market relevance. Strategic technology investments directly impact organisational effectiveness and growth potential.

Key strategic considerations for providers include:

- Aligning software selection with long-term operational and compliance objectives

- Leveraging predictive insights to guide workforce, service, and growth planning

- Choosing platforms that scale with participant numbers, workforce expansion, and organisational complexity

Providers seeking implementation guidance can follow the NDIS software 30-day implementation plan to structure a smooth transition with minimal disruption. Support coordination specialists can also access additional planning resources through VCCG and Hi-Five as part of a broader provider support network.

Reflecting on a Transformational Year

The NDIS software review 2025 highlights a transformative year as platforms evolved from basic administrative tools into fully integrated systems. These solutions now support compliance management, workforce coordination, and participant outcomes within a single operational ecosystem.

Providers increasingly adopted scalable and interoperable platforms, benefiting from automation, enhanced reporting, and user-friendly design. Pricing models shifted toward value-based structures, linking cost to participant volume, workforce size, and operational usage — reflecting a focus on long-term efficiency and sustainability.

Vendors combining reliability, innovation, and workflow alignment — such as Vertex360 — emerged as market leaders. Their performance set the stage for 2026, where data-driven, proactive software will be essential for driving operational efficiency, supporting growth, and delivering high-quality, compliant services.

Take Your NDIS Technology to the Next Level

See how Vertex360 helps providers manage compliance, workforce, and participant outcomes — all from $31.50 per month. Start your free 7-day trial with no credit card required, or explore affordable NDIS software options for small providers to find the right fit for your organisation.

Frequently Asked Questions

What were the key trends in NDIS software during 2025?

The NDIS software market in 2025 saw platform consolidation, increased automation, improved interoperability, and a shift toward value-based pricing. Providers prioritised integrated systems supporting compliance, workforce management, and participant outcomes.

How did pricing models change for NDIS software in 2025?

Vendors moved away from flat fees toward tiered and usage-based pricing. Costs linked to participant numbers, workforce size, and platform utilisation enabled scalable solutions for growing providers, while smaller providers needed to plan usage carefully.

Which features defined the leading NDIS software platforms in 2025?

Leading platforms focused on workflow automation, real-time reporting, enhanced data integrity, mobile accessibility, and seamless integration with finance and workforce systems.

What role did Vertex360 play in the NDIS software market in 2025?

Vertex360 strengthened its market position through compliance-focused improvements, platform stability, and scalability. Its integrated solutions supported operational visibility and efficient service delivery for providers of all sizes, starting from $31.50 per month.

What does the year-end NDIS analysis for 2025 reveal about provider technology strategies?

The year-end NDIS analysis shows providers using integrated platforms achieved faster invoicing, fewer compliance errors, and stronger audit readiness. Software selection became a strategic decision directly influencing long-term sustainability.

What should providers expect from NDIS software in 2026?

Providers can expect deeper automation, predictive analytics, enhanced interoperability, and data-driven decision tools. Platforms combining operational reliability, workflow alignment, and strategic insights will be critical for compliance and sustainable growth.